- Tomorrow's Fortune

- Posts

- 5 Habits of Highly Successful Investors

5 Habits of Highly Successful Investors

Tomorrow’s Fortune

Welcome to the action-packed newsletter designed to help you navigate the world of business and investing. If you missed last week’s post, check it out here. 😎

Today’s Digest:

Want to think like the best investors? It’s actually less about tactical finance skills, it’s more about having the right psychology… here’s 5 habits of the best

Groundswell Law: My go-to legal partner for all of my deals. Details below

What’s Happening in the Markets? Taylor Swift’s Box Office Success, 4G on the Moon, Gov’t Shutdown Ripple Effects on Layoffs and SORA’s AI Takeover

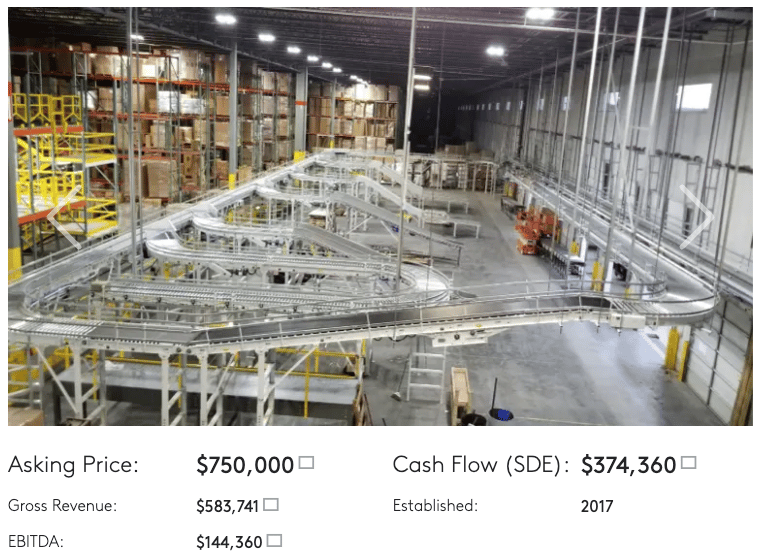

Deal Review: We found a cash flowing Conveyor Installation Business in Georgia ($374K of Cash Flow). Click HERE for the listing

TOP STORY

5 Habits of Highly Successful Investors

The best investors don’t have magic formulas or faster data feeds.

They have habits — simple ones — that compound over decades.

Here are five that separate the amateurs from the greats…

1. Patience: The Discipline to Wait Until It’s Obvious

Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.”

He wasn’t exaggerating. Buffett spent most of his career waiting — for valuations to make sense, for management to mess up, for opportunities to ripen. When the world moves at algorithmic speed, patience is the last true edge.

The best investors know that doing nothing is sometimes the most profitable move on the board.

Do this: Before you buy, write down the exact price or condition that would make you buy more. Then, when markets panic, follow your plan — not your emotions.

2. Curiosity: Obsession Over “Why,” Not “What”

Ray Dalio didn’t build Bridgewater by chasing returns. He built it by asking why things happen — in economies, politics, even psychology.

The best investors are detectives. They don’t just read 10-Ks; they hunt for causal loops, power structures, and hidden incentives. Curiosity compounds because every insight today becomes pattern recognition tomorrow.

Do this: Pick one industry you don’t understand — semiconductors, shipping, healthcare, whatever. Spend a week mapping how money actually flows through it. You’ll start spotting edge where others see noise.

3. Self-Control: Outsmarting Your Own Brain

Fear and greed are undefeated.

The only defense is process.

Self-control is why great investors can buy when headlines scream “collapse” and sell when CNBC is calling for melt-ups. They know emotion is the enemy of alpha.

Think about it — every crash is the same story: people who knew better got swept up in feeling worse.

Do this: Build your investing “constitution.”

Set rules like:

Never buy more than X% of portfolio in one day.

Never sell because of headlines.

Always wait 24 hours before acting on big decisions.

Rules beat emotions. Every time.

4. Detachment: Caring Deeply, But Not Personally

The best investors can lose $100M on a trade… and sleep fine. Not because they don’t care — but because they care about process, not ego.

Detachment lets you stay rational. It’s the emotional stop-loss. Buffett’s genius isn’t just stock picking — it’s that he doesn’t need to be right every time.

Do this: Once a quarter, review your portfolio as if it belonged to someone else.

Would you still hold everything? Would you make the same calls? The moment you detach identity from outcome, your decisions get sharper.

5. Thinking Against the Grain: The Courage to Be Early (and Alone)

Every great investment starts as a lonely one.

Peter Thiel’s fund backed Facebook when it was a college website. Buffett bought Coke when everyone thought it was a sleepy consumer brand. The best investors don’t chase consensus — they interrogate it.

It’s not about being contrarian; it’s about being right before others are.

Do this: Next time you hear “everyone’s saying…” — pause. Ask, Who benefits from that narrative? Then dig one layer deeper. Alpha lives under assumptions.

Special Thanks to Our Sponsor - Groundswell Law

Today’s newsletter is sponsored by Groundswell Law — my go-to partner for legal due diligence and documentation / negotiation on acquisitions for my holding company.

Groundswell Team of credible and expert lawyers provide sound guidance on:

End-to-end Legal Diligence: Structuring, diligence review and red flags reviews

Drafting & Negotiation: Preparing purchase agreements, subscription docs and other essential materials to close an acquisition / raise capital

Execution and Closing: Coordination, project management and documentation

They’re the group I trust on my own acquisitions, and if you’re serious about buying a business, they’re who you want in your corner.

Reach out to connect with the Groundswell team HERE to see if they can help you with the legal workstream on your next deal. Tell them Kenny Finance sent ya :)

Time to put these habits to the test - I found 7 businesses you can buy under $700k. Check it out on this week’s YouTube Video!

WHAT’S HAPPENING IN THE MARKETS?

Taylor Swift Film Dominates Box Office with $46 Million Global Debut

In a surprise blockbuster, Taylor Swift: The Official Release Party of a Showgirl earned $33 million domestically and $46 million globally in its three-day theater run. The event-style release—announced just two weeks prior—played across 7,000+ screens worldwide, marking one of the strongest limited-release openings in years. The success underscores Swift’s unprecedented pricing power and direct-to-fan monetization model that continues to upend traditional music and film distribution.

Why It Matters:

Swift’s success highlights the rise of “eventized entertainment,” where fandom-driven releases generate blockbuster-level ROI with minimal marketing spend. For investors, this points to continued opportunity in creator-led distribution models, especially for exhibitors like AMC seeking high-margin, limited-run content to offset declining traditional studio releases. Expect streaming platforms to experiment with similar hybrid drops to capture superfans at premium price points.NASA and Nokia to Deploy 4G Network on the Moon

NASA and Nokia have announced plans to install a 4G cellular network at the Moon’s south pole as part of a SpaceX mission later this year. The system—designed for data, video, and telemetry transmission—will serve as the backbone for long-term lunar operations, including autonomous rovers and eventual human settlement infrastructure. Nokia Bell Labs will operate the network remotely from Earth after deployment.

Why It Matters:

This project marks a major milestone in the commercialization of off-world connectivity. Beyond the symbolism, the buildout of lunar communications networks introduces new addressable markets for satellite telecom, defense contractors, and data relay firms. Investors should watch for secondary beneficiaries—low-orbit satellite providers, deep-space robotics firms, and materials suppliers poised to serve future lunar industrialization.Trump Shutdown Standoff Risks Federal Layoffs, Says Hassett

White House economic advisor Kevin Hassett warned that layoffs for federal employees could begin if President Trump deems current negotiations over the government shutdown “absolutely going nowhere.” The comments suggest rising pressure to resolve the fiscal impasse, which has already begun delaying contract payments and disrupting procurement pipelines. The standoff—now stretching into multiple weeks—continues to weigh on near-term consumption and confidence indicators.

Why It Matters:

Extended shutdowns historically shave 0.1–0.2% off quarterly GDP for every week they persist. A prolonged standoff could amplify liquidity stress for federal contractors and lower-income regions dependent on government spending. For investors, duration risk is key: the longer the freeze, the greater the knock-on effects in housing, retail, and municipal bond markets. Watch for Treasury yield curve reaction if default rhetoric intensifies.OpenAI’s Sora Tops App Store, Outpacing Gemini and ChatGPT

OpenAI’s new invite-only app Sora has surged to the No. 1 spot on Apple’s App Store, surpassing both Google’s Gemini and OpenAI’s own ChatGPT. The app enables users to generate and remix AI-powered short-form videos within a social feed environment, positioning it at the intersection of generative AI and creator platforms. Sora’s limited iOS rollout has driven viral engagement, signaling a potential new content format category.

Why It Matters:

Sora’s early traction cements OpenAI’s position as both infrastructure provider and consumer platform—blurring lines between model developer and media company. For investors, this accelerates the race between big tech ecosystems (Apple, Google, OpenAI) for AI-native social dominance. The implication: next-gen network effects may not come from text models, but from user-generated synthetic media ecosystems built atop them.

SO YOU WANT TO BUY A BUSINESS… 🏦

Deal of the Week: Georgia Conveyor Installation Firm – Asking $750,000

Opportunity Overview

Founded in 2017, this Georgia-based conveyor installation firm occupies a lucrative and often overlooked niche: turnkey mechanical installation of conveyor systems for manufacturing and distribution facilities across the U.S.

The company focuses exclusively on installation — not fabrication — allowing for a high-margin, asset-light model. With repeat commercial and industrial clients, the business has built a reputation for precision, reliability, and efficiency. Customers reportedly accept premium pricing due to superior quality and speed of execution — rare in a space often dominated by low-bid contractors.

Notably, the business operates at roughly one-third of annual capacity, yet still generates $374K in SDE on ~$584K revenue. For a buyer willing to either take a more active operational role or add a skilled millwright, there’s immediate white space for expansion.

With U.S. manufacturing reshoring and e-commerce warehousing driving conveyor demand, this niche is set to benefit from multi-year capital investment cycles.

Cash Flow and Profitability

At $583K in revenue and $374K SDE, this business boasts an extraordinary 64% SDE margin — driven by lean overhead, subcontracted labor, and direct owner involvement.

At a $750K asking price, the implied multiple is just ~2.0× SDE, well below the 3–4× range typical for mechanical contracting businesses with strong client relationships.

However, owner participation in both field and administrative work is substantial — about one-third of total on-site labor — meaning normalization for replacement management or technical labor could compress margins modestly.

Still, even with that adjustment, the business remains highly cash generative, with meaningful upside through utilization growth (from ~33% to 60–70% of annual calendar weeks).

What We Like

1. Strong Reputation in a Quality-Driven Niche

Conveyor installation requires precision and safety discipline. This firm has built a loyal base willing to pay above-market rates for high-quality execution — rare in a commoditized contracting environment.

2. High Margins / Low Overhead

No facility lease, low inventory, and subcontracted labor create a capital-light structure. Cash conversion is exceptional for a construction-adjacent business.

3. Repeat Client Base

Recurring industrial customers reduce bid volatility and smooth scheduling. Relationship continuity with major distributors and manufacturing facilities is a competitive moat.

4. Underutilized Capacity = Built-In Growth

Operating just 17 weeks per year leaves massive headroom for revenue growth without proportional cost increases.

5. Strong Industry Tailwinds

Reshoring, automation, and warehouse expansion (driven by e-commerce and nearshoring trends) continue to boost conveyor demand — supporting long-term growth.

What We Don’t Like

1. Owner Dependency

The seller is central to both labor and operations — a key-person risk. A buyer must either step into that role or budget for a senior millwright/project lead.

2. Limited Scale / Staff Depth

Only two contractors and heavy subcontractor reliance mean execution capacity is thin. Growth will require workforce expansion and stronger scheduling systems.

3. Customer Concentration Risk

The listing notes “repeat customers,” but does not specify concentration. A small set of recurring industrial clients could expose the business to volume risk if one relocates or insources.

4. No Recurring Maintenance or Service Revenue

All income appears project-based. Adding conveyor maintenance or inspection contracts would create recurring cash flow and higher valuation multiples.

5. Manual Operations

Home-based operations and limited back-office structure suggest administrative inefficiencies — though that also provides a professionalization opportunity for a buyer.

Key Questions for Diligence

What percentage of revenue comes from repeat versus new customers?

Understanding the true retention rate will inform revenue durability and pricing power.How is SDE adjusted for owner labor?

A key diligence step is modeling normalized EBITDA after replacing the owner’s dual role (field and admin).What is the pipeline and backlog visibility?

Project duration, award frequency, and scheduling gaps are crucial for assessing scalability.How are subcontractors sourced and compensated?

Stability of the labor pool is essential in a skilled-trades business with tight deadlines.What safety, licensing, or insurance requirements apply?

Conveyor installs may require OSHA, lockout/tagout training, or site-specific credentials — compliance lapses can threaten client eligibility.Are there opportunities to add maintenance or retrofit services?

Preventative maintenance, conveyor audits, and minor repair contracts can smooth revenue volatility and improve multiples.

Bottom Line

At just 2.0× SDE, this Georgia conveyor installer offers a compelling entry into a niche industrial services market with strong structural tailwinds. The company’s lean model, repeat customers, and underutilized calendar create significant upside for an operationally capable buyer.

The trade-offs are clear: transition risk, owner dependency, and thin staffing — all solvable with process discipline and labor investment. For an acquirer in adjacent trades (material handling, industrial maintenance, mechanical contracting), this is a high-ROI bolt-on with cash-on-cash returns exceeding most market alternatives.

Think of it as buying a high-trust, under-scaled operator in a booming logistics infrastructure niche — the kind of “dirty hands, clean margins” business PE loves to professionalize.

This newsletter is for informational purposes only and does not constitute investment advice. The content is based on publicly available information, and the author makes no representations about its accuracy or completeness. Readers should conduct their own research before making any investment decisions.