- Tomorrow's Fortune

- Posts

- How Much to Pay Yourself Once You Own a Business?

How Much to Pay Yourself Once You Own a Business?

Tomorrow’s Fortune

Welcome to the action-packed newsletter designed to help you navigate the world of business and investing. If you missed last week’s post, check it out here. 😎

Today’s Digest:

What Should Your Salary Be as the new Owner? TLDR: It’s not as much as you think it should be… welcome to the world of business ownership

What’s Happening in the Markets? U.S. Gov’t Shutdown Finally Over, First Brands Bankruptcy, U.S. x Switzerland Signs Trade Deal, and Tencent’s Earnings

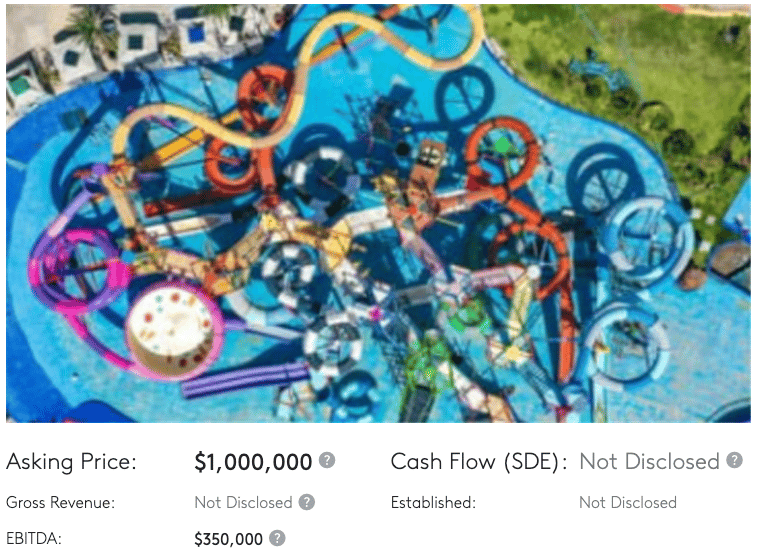

Deal Review We found a cash flowing Speciality Construction business in Ohio ($350K of Cash Flow). Click HERE for the listing (Deal Review Below)

🚨The Deal Team🚨: The private community for business buyers, owners and investors is finally launching next month! Will have all of the resources you need to buy / grow a business - community, model / doc templates, AMAs with me, deal reviews and super cool guest speakers! Applications dropping soon!

TOP STORY

Deciding on Your New Paycheck…

Most new owners ask the wrong question:

“How much can I pay myself?”

The real operators — the ones who build businesses worth 7–8 figures over time — ask a different question:

“What’s the minimum I should take so the business compounds?”

Because once you own a business, your incentives flip.

You’re not an employee anymore.

You’re an investor.

And investors get wealthy by letting the asset compound, not by squeezing it dry.

Here’s the simple framework.

1. Pay Yourself a Minimal Salary (On Purpose)

As an owner, your salary should be:

The lowest reasonable salary required for tax and SBA purposes.

Why?

Because salaries are taxed at ordinary income rates and payroll taxes. Distributions usually aren’t.

A salary keeps the IRS happy.

A small salary keeps more money compounding in the business.

Your W-2 paycheck isn’t where you win.

Your equity is.

2. Use Distributions to Cover Your Life — But Don’t Overdo It

After salary, the money you take out should be:

Just enough to cover your basic lifestyle — not your aspirational one.

Example:

If the business generates $300K in free cash flow, you don’t take $300K.

You might take $100–120K and leave the rest to work.

Distributions are flexible, tax-efficient, and protect your personal finances.

But the golden rule is simple:

Pull the cash you need.

Leave the cash the business needs.

3. Let Most of the Cash Stay in the Business (This Is Where You Get Rich)

Your business should be the highest-returning asset you own.

If it isn’t?

You bought the wrong business.

Most $1–5M businesses, when run well, generate returns that destroy index funds:

SBA leverage magnifies equity returns

High incremental ROIC (each dollar reinvested often produces multiple dollars of profit)

Small improvements — pricing, scheduling, marketing — create disproportionate gains

If your business earns 30–60% ROIC, why rip cash out to put into an index fund making 7–10%?

Index funds are amazing.

But your business should beat them.

That’s the whole point of being an owner.

The Simple Owner Compensation Formula

Here’s the framework I give every first-time owner:

Owner Salary:

→ Pay the minimum reasonable amount (tax-friendly, SBA-friendly)

Owner Distributions:

→ Cover your costs of living, nothing more

Retention / Reinvestment:

→ Every other dollar stays in the business

→ Until the business reliably produces excess cash it cannot reinvest at high returns

At that point?

You still don’t splurge.

You start allocating to the markets.

This is the same discipline Buffett used at the textile mill,

the same playbook PE funds use with portfolio companies…

and the same approach that separates rich operators from struggling ones.

A Quick Example

Business Free Cash Flow: $250K

Recommended structure:

$70–90K salary (baseline W-2)

$60–80K distributions (covers your life)

$80–120K retained + reinvested

hiring

marketing

AI systems

debt repayment

M&A

In 3–5 years, that reinvested capital compounds into a bigger, stronger, more valuable company.

That’s how owners get wealthy.

Not from the salary.

From the compounding.

Bottom Line

Once you own a business, your paycheck stops being the main character.

The asset becomes the main character.

Think like an investor:

Pay yourself enough to live.

Take a little more for comfort.

Reinvest the rest into the business that feeds you.

If your business is truly high quality, the returns will eclipse anything you could earn in the market.

And if it can’t beat the market?

You shouldn’t own it.

You should index.

Shared all my business growth secrets I learned at Blackstone in this YouTube Video!

WHAT’S HAPPENING IN THE MARKETS?

Historic Shutdown Ends After Funding Bill Passes

Well it took a while to align both parties, but on Thursday, President Trump signed a funding bill ending the longest government shutdown in U.S. history, following a 222–209 House vote. Hundreds of thousands of federal workers have been instructed to return to work Thursday, marking the end of a protracted standoff that halted agencies, froze procurement, and delayed federal programs.

Why It Matters:

The shutdown’s end removes a major overhang on Q1 GDP and federal contracting cycles, but the economic scarring doesn’t disappear overnight. Delayed spending, lapsed payments, and catch-up contracting will create volatility for defense, aerospace, transportation, and agencies tied to grant flows. Markets will now watch whether this showdown becomes a precedent for recurring fiscal brinkmanship heading into an election year — a dynamic that historically widens credit spreads and depresses federal-exposed industrial names.Howard Marks Warns on Credit “Carelessness” — But Says It’s Not Systemic

Oaktree’s Howard Marks highlighted rising “complacency” and “carelessness” in credit markets following the collapse of auto-parts supplier First Brands — a bankruptcy that JPMorgan’s Jamie Dimon called the first of several upcoming “cockroaches.” Marks emphasized that defaults shouldn’t surprise anyone given the rate environment, but he does not view current stress as systemic.

Why It Matters:

Marks is drawing a line between episodic fragility and systemic contagion — but the subtext matters for investors. First Brands’ collapse wasn’t random; it exposed overstretched consumer lenders, aggressive levered credit structures, and weakening demand from middle-income households. These micro-stresses often precede macro cracks. For credit and equity investors, cases like this serve as early-warning diagnostics: borrower-level stress can foreshadow wider deterioration in consumer, autos, and subprime-adjacent credit channels.U.S. and Switzerland Strike Trade Deal, Cut Tariffs to 15%

The U.S. and Switzerland have reached an agreement to reduce bilateral tariffs to 15%, according to USTR Jamieson Greer. Switzerland confirmed the deal publicly and added that further details will be released later today. As part of the agreement, Swiss companies have pledged $200 billion of U.S. investment by 2028.

Why It Matters:

This is one of the first major tariff-rollback deals of Trump’s second term and signals a softer tone with allied trading partners at a time of intensifying pressure with China. The $200B investment pledge is meaningful — particularly for U.S. pharmaceuticals, precision manufacturing, and specialty chemicals, where Swiss firms are global leaders. For markets, this reduces uncertainty for transatlantic supply chains and could re-rate export-sensitive industrials. It also gives the administration a diplomatic “win” ahead of more adversarial negotiations with Beijing.Tencent Revenue Jumps 15% as AI Spending and Gaming Strength Drive Growth

Tencent reported a 15% YoY revenue increase, fueled by accelerated AI investment, expanding cloud infrastructure in Europe, and strong performance across gaming, advertising, and social platforms. Earlier this year the company boosted capex to ramp up AI model development and cloud GPU capacity — a strategic move mirroring U.S. hyperscalers.

Why It Matters:

Global investors continue to underestimate Asia tech’s upside — both in scale and innovation velocity. Tencent is positioning itself as a regional AI and cloud powerhouse, with gaming cash flows subsidizing long-term infrastructure investments. Unlike U.S. big tech, Chinese tech valuations remain structurally discounted due to geopolitical risk, creating asymmetric opportunities if the sector enters an early-innings secular bull run. For allocators, this is a reminder: the world’s next trillion-dollar AI winners may not be U.S.-listed.

SO YOU WANT TO BUY A BUSINESS… 🏦

Deal of the Week: Specialty Refractory & Amusement Construction Firm – Asking $1.0M

Opportunity Overview

This Ohio-based specialty construction and refractory manufacturing firm has operated for 17 years, serving a niche but defensible market: amusement park rides, splash pads, and specialty refractory applications.

This is not general contracting. It’s a technical, compliance-driven trade with few credible competitors. The company handles high-spec concrete, coatings, heat-resistant materials, and theme-park-grade refurbishment — all categories with recurring, mandated maintenance cycles.

With ~$350K EBITDA and a decade-plus of reputation in a safety-sensitive vertical, the business offers exactly what investors want but rarely find in construction: recurring institutional customers, high switching costs, and real moat created by certification, experience, and liability barriers.

At a ~2.9× EBITDA valuation, this is priced like a commodity contractor — but operates like a specialty industrial services firm. The mismatch creates the upside.

Cash Flow and Profitability

The firm produces $350K in EBITDA, implying a margin in the ~14–18% range based on typical amusement/refractory project economics. For specialty trades, that’s healthy.

At the $1.0M asking price, the multiple is ~2.9× — well below the 4–6× range that niche industrial contractors with recurring institutional work typically command.

Most importantly:

Amusement parks and splash grounds have mandatory annual off-season refurbishment cycles

Refractory work is specialized, non-discretionary, and regulated

Vendor qualification requirements reduce competitive entry

This means the cash flow is stickier and more defensible than the price suggests.

If you’re a strategic buyer in coatings, industrial services, or specialty construction, this is a bolt-on that immediately enhances margin profile and customer diversification.

What We Like

High Barriers to Entry

Refractory manufacturing + amusement ride refurbishment is a niche requiring certifications, safety compliance, specialized materials knowledge, and insurance levels most contractors can’t satisfy. Few firms can bid this work.

Recurring, Compliance-Driven Demand

Water rides, basins, coatings, and refractory linings degrade annually. Parks cannot skip maintenance without failing inspections — creating predictable off-season revenue.

Strong Pricing Power

Specialty trades with high liability and few alternatives command premium margins. Switching vendors is costly and risky for park operators.

Attractive Entry Multiple

Buying at <3× EBITDA for a technical service business with recurring institutional customers is a rare find.

Expansion Optionality

Clear paths: more regional parks, municipal splash pads, industrial refractory, waterparks, hotels, and resort attractions. Growth relies on staffing, not heavy CapEx.

What We Don’t Like

Possible Customer Concentration

Theme parks can be large accounts. Need to verify no single client makes up >25% of revenue.

Owner Technical Knowledge Risk

After 17 years, the founder likely holds key tribal knowledge. Transition plan and retention of foremen/crew leads is essential.

Seasonality

Amusement work is off-season heavy. Must evaluate whether industrial refractory provides year-round balance.

Limited Financial Disclosure

Revenue not provided. Need visibility into gross margins by service line and backlog health.

Key Questions for Diligence

Revenue mix: amusement vs. municipal vs. industrial refractory?

Any customer >20% of annual revenue?

What certifications and safety credentials does the company hold?

How much technical decision-making sits with the owner?

Backlog size + win rate on bid pipeline?

Gross margin by service type (coatings, refractory, ride refurbishment)?

What CapEx is required to maintain equipment?

Bottom Line — Verdict: ✅ Cautious First Bid

We really need more data on this to confirm a buy - but assuming the numbers check out, this is a niche industrial services business priced like a general contractor. The 17-year operating history, high barriers to entry, compliance-driven recurring demand, and strong EBITDA multiple make this a compelling acquisition.

You’re not buying a commodity contractor.

You’re buying a specialized, defensible position in a vertical with few competitors and sticky, institutional customers.

This is exactly the type of overlooked industrial niche where private investors quietly generate outsized returns.

Think of it like buying the only repair shop licensed to service a specific type of roller coaster — the work keeps coming, whether the economy is booming or not.

This newsletter is for informational purposes only and does not constitute investment advice. The content is based on publicly available information, and the author makes no representations about its accuracy or completeness. Readers should conduct their own research before making any investment decisions.