- Tomorrow's Fortune

- Posts

- My Secret Tactic to Find Businesses to Buy...

My Secret Tactic to Find Businesses to Buy...

Tomorrow’s Fortune

Welcome to the action-packed newsletter designed to help you navigate the world of business and investing. If you missed last week’s post, check it out here. 😎

Today’s Digest:

Sourcing Proprietary Deals: I dive into one of my favorite sourcing techniques for local cash flowing businesses that you won’t find on BizBuySell

What’s Happening in the Markets? Booming Defense Businesses, NBA’s Gambling Shakedown, Trump’s Tariffs (again) and AI’s Spending Impact

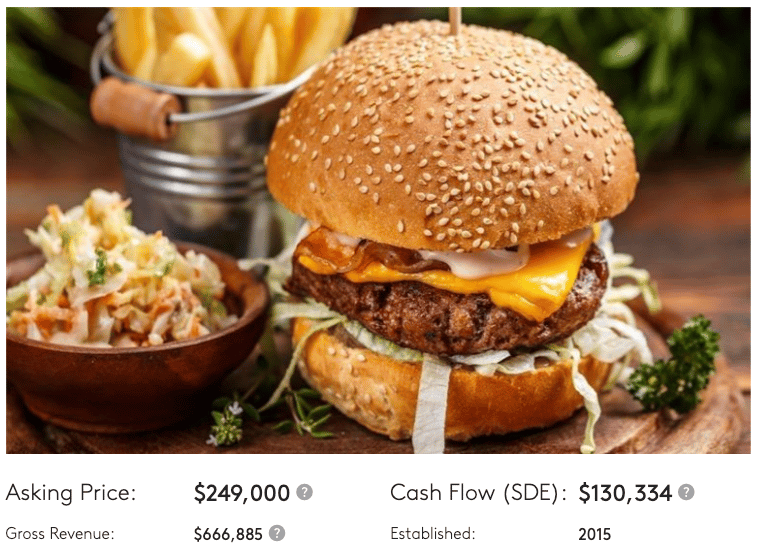

Deal Review: You guys liked the Anti-Investment Memo last week (showcasing businesses we’d pass on) - I found another one that’s more typical of “bad businesses” - a Florida American Dining Restaurant Business ($130k of Cash Flow). Click HERE for the listing

TOP STORY

Finding the Best Businesses in Your Area

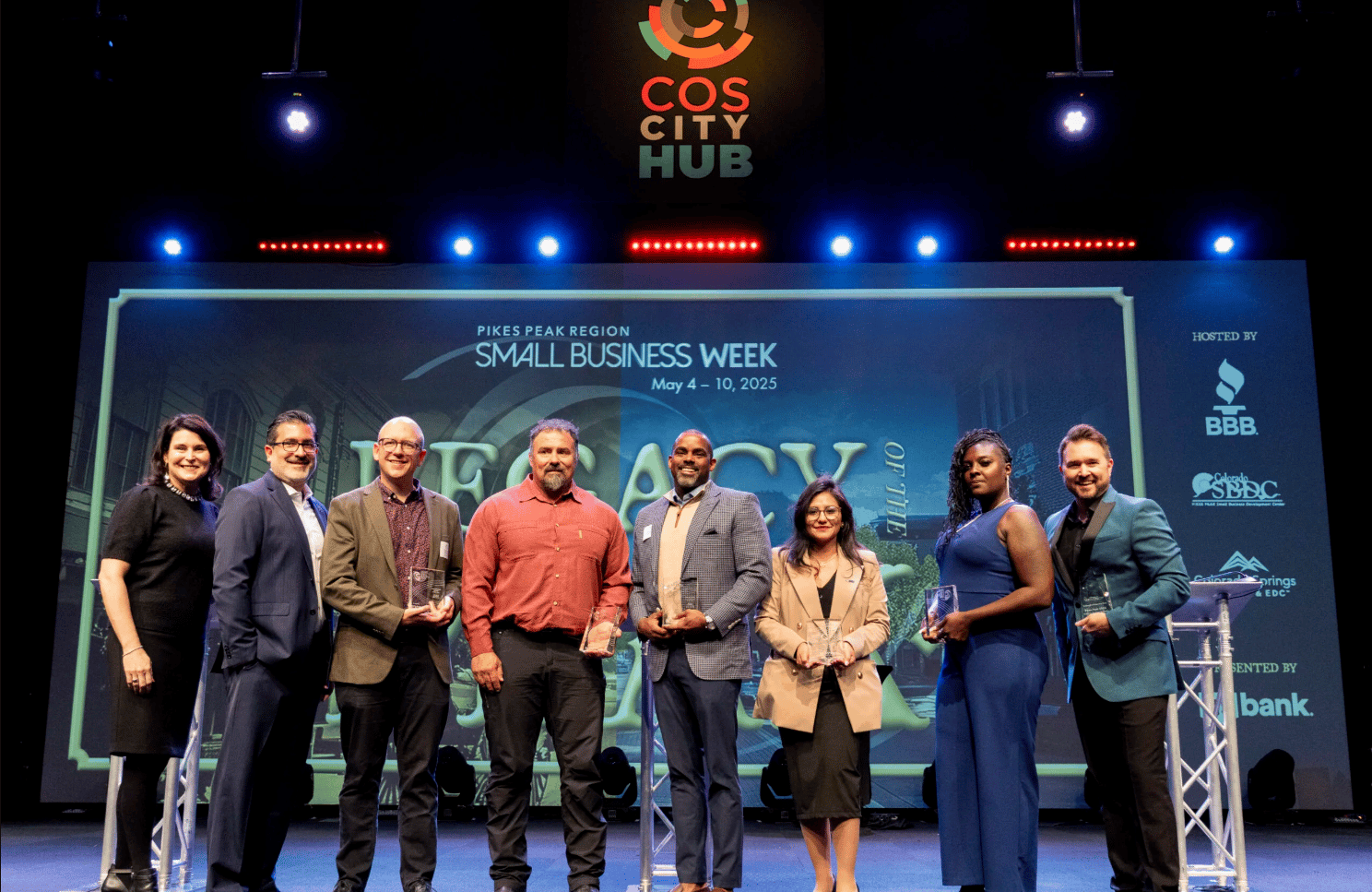

You’re probably wondering who all these people are?… well… they’re CEOs and Business Owners of the 2025 Pikes Peaks Region (CO) Small Business Week Awards… aka prime acquisition targets for Colorado Business Buyers. Oh yeaaa. let’s cook!

Here’s a sourcing secret almost no one talks about…

If you want to find great small businesses before brokers list them — don’t start with BizBuySell.

Start with local award lists.

I’m serious.

Those “Best of [Your City]” business awards you see in community newspapers or Chamber of Commerce emails?

They’re a goldmine.

Let me show you my five reasons why:

Most small business owners don’t market nationally.

They win locally.

So when a HVAC company wins “Best Heating & Cooling Service in Austin” or a bakery wins “Best in Orange County,” that’s a signal — not of hype, but of reputation.

Those are the companies that quietly dominate their zip code… not the ones blasting ads online.

And local loyalty → recurring cash flow.

2. They’re Often Founder-Led and Near Retirement

Here’s the best part.

The owners of these “Best of” businesses are often in their late 50s or 60s.

They’ve been at it for 20+ years. They’re respected. Profitable. And tired.

Translation?

Prime acquisition targets.

A short, respectful email like:

“Hi [Owner Name], I saw [Business Name] was voted Best [Category] in [City]. Congrats — impressive achievement. If you’re ever open to discussing a transition or partnership, I’d love to learn more about your story.”

You’d be surprised how many reply.

3. Local Chambers and Newspapers Do the Work for You

Instead of paying for databases, let others surface winners.

Google:

“Best of 2024 small business awards + [your city or state]”

“Chamber of Commerce award winners + [industry]”

“Top family-owned businesses + [region]”

Save those names into a CRM. Research their websites. Then send 5 outreach emails per week.

That’s how you quietly build a proprietary deal pipeline — while everyone else scrolls BizBuySell filters.

4. Combine It with Google Reviews and Secretary of State Filings

Once you have your list, verify.

Check:

✅ 4.8+ star Google rating

✅ Been around 10+ years

✅ Locally owned (not a franchise)

✅ Steady web presence

Then look up the LLC registration date — longevity is a strong trust signal.

5. Don’t Wait for a “For Sale” Sign

By the time a great business is listed, 20 buyers are already circling.

You want to be the one who gets the quiet coffee meeting before the idea of selling even hits the market.

The best deals are the ones you source, not the ones you find.

The Big Idea: Be the Buyer Who Shows Up Before the Banker

The wealthiest acquirers don’t compete for listings.

They build relationships years before an exit.

Local award lists are how you start that process — cheap, fast, and hidden in plain sight.

This week, pick your city.

Pull 3 “Best Of” lists.

Email 5 owners.

That’s how you find the kind of business everyone wishes they’d bought — right before it disappears.

I found a BioHazard cleanup business in CA using this sourcing method and interviewed them in this week’s YouTube Video

WHAT’S HAPPENING IN THE MARKETS?

Defense Giants Lift Guidance on Surging Global Demand

Major U.S. defense contractors — GE Aerospace, Northrop Grumman, RTX, and Lockheed Martin — all raised their 2025 outlooks after topping Q3 earnings estimates, citing escalating global demand and renewed government procurement momentum. The results come as markets digest policy uncertainty tied to tariffs and the temporary government shutdown.

Why It Matters:

Defense is emerging as a macro hedge amid trade volatility and geopolitical fragmentation. Rising order backlogs reflect rearmament cycles across NATO and Asia-Pacific allies, while higher-margin aerospace demand compounds the upside. Expect multiple expansion for defense primes as investors rotate toward national security–linked cash flows insulated from consumer cyclicality.Illegal NBA Betting Scandal Puts Spotlight on Sportsbooks

A sweeping FBI probe into illegal NBA gambling led to the arrests of Portland Trailblazers coach Chauncey Billups and Miami Heat guard Terry Rozier — reigniting scrutiny over the intersection of pro sports and betting. Legal operators like FanDuel and DraftKings reiterated integrity safeguards as shares dipped on renewed regulatory concerns.

Why It Matters:

The scandal underscores persistent gray zones in U.S. sports betting, where insider access and offshore wagering still undermine legal-market credibility. For investors, increased enforcement could delay state expansion or trigger compliance costs, but may also entrench market leaders with stronger governance infrastructure. Expect short-term volatility but long-term consolidation tailwinds favoring scaled, regulated operators.Trump Escalates Trade War with 10% Tariff on Canada

President Trump announced a fresh 10% tariff on Canadian imports, citing a “misleading” ad featuring Ronald Reagan criticizing his trade policy. The escalation adds to ongoing friction ahead of his Asia tour, where the administration seeks limited agreements with Japan, Malaysia, and China. Markets remain skeptical of meaningful de-escalation, as both sides hint at only modest tariff relief or commodity purchases.

Why It Matters:

The new tariff underscores how trade tensions are once again becoming a macro driver into year-end. Investors should watch for knock-on effects in autos, agriculture, and aerospace, sectors heavily reliant on cross-border supply chains. The broader signal: Trump’s trade posture remains a wildcard for inflation expectations and Fed trajectory — reintroducing political risk premia to global markets.AI Boom Masks a Two-Speed Economy

Artificial intelligence spending continues to power U.S. GDP and equity indices to record highs, with Nvidia and its peers driving the bulk of market gains. But small and mid-sized businesses are increasingly strained by tariffs, high input costs, and weak consumer sentiment. Many local operators report operating in “survival mode” despite headline growth figures.

Why It Matters:

The divergence between the AI-driven capital markets boom and the real economy is widening. This bifurcation points to fragility beneath the surface — strong nominal growth paired with weak diffusion of benefits. For investors, it signals potential rotation risk if policy or rates tighten liquidity to the AI complex, and opportunities in distressed small-cap or industrial sectors trading below intrinsic value.

SO YOU WANT TO BUY A BUSINESS… 🏦

Deal of the Week (Pass): Florida Family Restaurant – Asking $249,000

Opportunity Overview

This Sarasota County “American Grill” presents itself as a semi-absentee restaurant investment generating $130K in SDE on ~$667K in annual sales. Operating for about a decade under family ownership, the business offers breakfast, lunch, and dinner service six days a week from a 1,500 sq. ft. leased space with ~60 seats and $2,700/month rent.

On paper, it looks like a “lifestyle investment” — low rent, consistent traffic, and a family willing to stay on post-sale. But scratch the surface, and it’s exactly the kind of business sophisticated buyers should avoid.

The core problem: this is an undifferentiated, small-footprint diner — a notoriously fragile business model with zero moat, key-person dependency, and minimal scalability. The “semi-absentee” pitch is misleading (as it almost always is in food service), and the recent $20K price reduction signals weak buyer demand and likely operational fatigue.

At best, this is a job disguised as an investment. At worst, it’s a slow bleed of capital and time.

Cash Flow and Profitability

The restaurant produces ~$130K SDE on $667K in sales — roughly a 19% margin, which is respectable for the category but thin once adjusted for true owner involvement. After paying a full-time manager (the seller’s son) a market salary, normalized cash flow likely drops closer to $60–70K.

At the $249K asking price, the effective multiple balloons from ~1.9× to over 4× EBITDA-adjusted cash flow — a high valuation for a low-barrier, labor-intensive business with limited growth potential.

Restaurant SDEs are often padded with owner hours, unpaid family labor, and unsustainable cost structures. The fact that the owner’s family fills multiple roles means much of that margin will vanish under new ownership.

What We Like

Low Fixed Overhead

Rent of just $2,700/month provides flexibility and lowers break-even, giving the operator some breathing room in a downturn.Established Local Customer Base

Ten years of operation indicates some community stickiness and predictable foot traffic.Existing Staff Continuity

Having staff willing to stay on post-close can help preserve short-term stability during transition — though not a substitute for durable leadership.

What We Don’t Like

The “Semi-Absentee” Myth (Major Red Flag)

There’s no such thing as a truly absentee diner. Margins in food service are too thin and quality control too critical. The owner’s son currently manages the entire operation — take him out, and the structure collapses.No Differentiation / No Moat

“American grill” is the most saturated menu category in casual dining. No unique cuisine, brand, or proprietary process = no pricing power and constant competitive churn.Short Track Record by Restaurant Standards

Ten years may sound long, but the best independent restaurants have 30–100 years of sustained local following. This one hasn’t yet proven generational staying power.Price Reduction = Weak Demand Signal

A $20K cut on a sub-$300K listing suggests limited buyer interest and possibly declining performance. Buyers are already skeptical — for good reason.Labor and Succession Risk

Family-heavy staffing structure = hidden fragility. Once the seller retires and familial motivation disappears, turnover risk rises sharply.Limited Upside / Scalability

Expansion options like “delivery and catering” are superficial. Without a strong brand or menu differentiation, incremental sales will not materially change margins.

Key Questions for Diligence

How much of the reported SDE comes from unpaid or underpaid family labor?

What’s the adjusted EBITDA after hiring a market-rate GM?

What is same-store sales growth (or decline) over the last three years?

How dependent is the business on local regulars vs. tourist traffic?

Are there any deferred maintenance, health code, or lease renewal risks?

What are wage inflation and food cost trends doing to gross margins?

Bottom Line

At first glance, this looks like a simple, affordable restaurant with stable sales and “semi-absentee” appeal. In reality, it’s a classic trap deal — an undifferentiated small diner that’s barely producing replacement-level cash flow once normalized.

Restaurants like this often sell on narrative (“family-owned, great locals, turnkey”), but the underlying economics don’t justify the risk. You’re buying a $60K/year job with 16-hour days, operational fragility, and commodity competition.

If the seller’s own family wants out after a decade, that should tell you everything.

Verdict: 🚫 Pass.

Low differentiation, illusory absentee potential, and capped returns make this a non-starter for disciplined investors. Save your time and capital for defensible cash-flow assets — not another “American grill” in a sea of them.

Think of it like this: You’re not buying a restaurant; you’re buying a treadmill that someone else is finally stepping off.

This newsletter is for informational purposes only and does not constitute investment advice. The content is based on publicly available information, and the author makes no representations about its accuracy or completeness. Readers should conduct their own research before making any investment decisions.