- Tomorrow's Fortune

- Posts

- The ONE Metric That Predicts Every Great Deal (only pros use)

The ONE Metric That Predicts Every Great Deal (only pros use)

Tomorrow’s Fortune

Welcome to the action-packed newsletter designed to help you navigate the world of business and investing. If you missed last week’s post, check it out here. 😎

Today’s Digest:

Beginners talk about SDE… Rookies talk about EBITDA… but the pros focus on this true yield metric to identify good deals…

What’s Happening in the Markets? Oil Rises on Venezuela Tensions, Build-a-Bear’s Comeback Story, Trump Unplugs Offshore Wind, and TikTok’s U.S. JV

Deal Review: We found a cash flowing Porta Potty Business in Wisconsin ($308k of Cash Flow). Click HERE for the listing (Deal Review Below)

🎄 Happy Holidays 🎄

Wishing you and your loved ones a very special holiday season! Hopefully (after you’re done reading this newsletter), you have the chance to unplug and relax as you recharge ahead of an exciting 2026 journey!

TOP STORY

The One Metric That Predicts Every Great Deal

Most buyers anchor on the wrong numbers.

Revenue.

EBITDA.

Purchase multiple.

Serious investors don’t.

They underwrite one question:

What is my free cash flow yield on equity?

That single metric tells you the actual return you’re earning — and allows you to compare a private business acquisition to public equities, real estate, or credit on a like-for-like basis.

First, Let’s Get the Definitions Right

Precision matters.

Revenue

Scale, not returns.

EBITDA

A rough measure of operating performance before capital structure, taxes, and reinvestment. Useful for benchmarking — insufficient for valuation.

Free Cash Flow

Cash available after:

Operating expenses

Cash taxes

Maintenance CapEx

Changes in working capital

Interest and required debt amortization

This is the cash the owner can actually distribute.

Free Cash Flow Yield = Annual Free case Flow ÷ Equity Invested

This is your true return on capital.

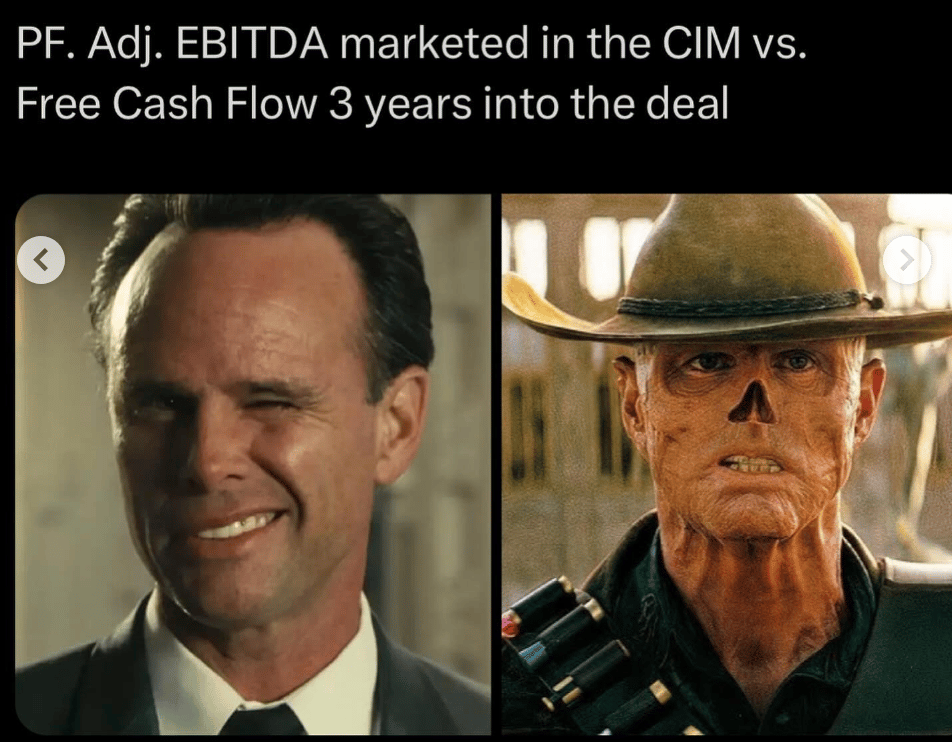

Why EBITDA Alone Misleads Buyers

Two businesses can have identical EBITDA and radically different equity returns.

EBITDA ignores:

Capital intensity

Ongoing reinvestment requirements

Working capital drag

Debt service

Free cash flow does not.

That’s why sophisticated investors care less about the headline multiple and more about what drops to equity after everything is paid.

How Professionals Actually Underwrite Deals

Institutional investors don’t ask: “What EBITDA multiple am I paying?”

They ask: “What is my stabilized free cash flow yield on equity - and how resilient is it?”

Example:

$1.6M enterprise value

$800K debt

$800K equity invested

$200K annual free cash flow to equity

25% cash-on-cash return.

That number is immediately comparable to:

Public equities

Private credit

Real estate cap rates

Other buyout opportunities

This is how capital is allocated rationally.

Why This Separates Pros From Amateurs

Amateurs buy businesses based on:

Cheap multiples

Adjusted EBITDA

Growth stories

Professionals buy businesses based on:

Cash generation

Capital efficiency

Return on equity

High free cash flow yield gives you:

Faster payback

Downside protection

Flexibility to de-lever, reinvest, or distribute

Low-yield deals demand flawless execution.

High-yield deals compound even with mistakes.

I Found The 5 Most Profitable Businesses You Can Buy Under $50k

WHAT’S HAPPENING IN THE MARKETS?

Oil Rallies as U.S. Escalates Enforcement Against Venezuela

Oil prices jumped after reports that the U.S. intercepted a Venezuelan oil tanker in international waters, signaling a more aggressive enforcement stance on sanctioned crude. Brent closed above $62 and WTI near $58, despite an otherwise bearish macro backdrop. Venezuela represents only ~1% of global supply, but the move adds geopolitical risk premium amid ongoing Russia–Ukraine tensions and disruptions to shadow fleets.

Why It Matters:

This isn’t about Venezuela volumes — it’s about enforcement credibility. The market has largely priced sanctions leakage as a feature, not a bug. A harder U.S. line introduces tail risk in a market already struggling with weak demand and ample supply. Near-term price support may persist, but without follow-through on broader supply constraints, rallies risk fading. Energy remains a trading market, not a structural long.Build-A-Bear’s Quiet Retail Turnaround

Once written off as a mall-era relic, Build-A-Bear has staged a disciplined comeback under CEO Sharon Price John. The playbook was straightforward: fix profitability first, invest in e-commerce, diversify beyond malls, and expand through international franchising. Nearly all stores are now profitable, and the stock is up over 125% in two years despite recent volatility.

Why It Matters:

This is a case study in operational execution, not multiple expansion. Build-A-Bear didn’t reinvent demand — it optimized unit economics, capital allocation, and channel mix. For investors, it reinforces a familiar lesson: in retail, survival and returns come from cost discipline and cash flow durability, not growth narratives. The stock’s pullback may matter less than whether margins hold in a slowing consumer environment.Trump Suspends Offshore Wind Projects Under Construction

The Trump administration announced a suspension of all large offshore wind farms currently under construction, citing national security concerns. The move halts billions in investment and delays nearly six gigawatts of capacity, including a major Virginia project intended to supply power to one of the world’s largest data center hubs.

Why It Matters:

This materially raises regulatory risk across U.S. renewables. Offshore wind was already challenged by rising costs, financing strain, and permitting delays — this adds a political overhang that capital markets will not ignore. Ironically, the suspension comes as power demand accelerates due to AI and data centers. Expect knock-on effects: higher regional power prices, tighter capacity, and renewed interest in gas, nuclear, and grid infrastructure as “safer” capital destinations.TikTok Creates U.S. Joint Venture with Oracle, Silver Lake, and MGX

TikTok signed an agreement to house its U.S. operations in a new joint venture, TikTok USDS Joint Venture LLC, with Oracle, Silver Lake, and Abu Dhabi-based MGX as managing investors. The structure appears designed to address national security concerns while keeping TikTok operational in the U.S. market.

Why It Matters:

This is a de-risking maneuver, not a growth catalyst. The JV structure buys TikTok time and political cover, but governance, data control, and ultimate ownership questions remain unresolved. For investors, the takeaway is broader: geopolitics now directly shapes platform valuations. Strategic assets with regulatory exposure increasingly trade with an embedded political discount — and optionality, not fundamentals, is driving outcomes.

SO YOU WANT TO BUY A BUSINESS… 🏦

Deal of the Week (Pass): Central Wisconsin Portable Sanitation Business – Asking $1.6M

Opportunity Overview (Listing Here - it’s still for sale!)

This Central Wisconsin portable sanitation business has operated for nearly 30 years, serving construction sites, events, and municipalities in a rural regional market. Founded in 1996, it positions itself as a local monopoly with no direct competitors and recession-resistant demand.

Portable sanitation is a boring, essential service — exactly the type of industry private equity likes. The question isn’t whether the industry works, but whether this asset compounds capital.

Cash Flow, Scale, and Valuation

The business generates ~$668K in revenue and ~$308K in SDE, implying a ~46% margin. At the $1.6M asking price, the deal prices at ~5.2× SDE, translating to a mid-single-digit Free Cash Flow yield after normalizing for:

Fleet replacement CapEx

True market owner compensation

Maintenance and compliance costs

That multiple is full for a sub-$1M revenue business in a low-density, rural market.

What Actually Drives Value in This Niche

Portable sanitation businesses compound through:

Route density

Contracted construction and municipal work

Fleet utilization efficiency

This business appears to benefit more from geographic isolation than structural advantage. “No competitors” reflects limited market depth, not a durable moat.

If density economics were compelling, competitors would already be present.

What We Like

Essential, non-discretionary service tied to construction and infrastructure

30-year operating history with embedded customer relationships

Hard asset backing (~$570K in equipment) limits downside

Operational simplicity with lean overhead

What We Don’t Like

Subscale geography limits growth and pressures margins on expansion

SDE likely overstates true EBITDA at this size

Meaningful replacement CapEx can quickly compress margins

Constrained exit optionality — likely another owner-operator, not a strategic buyer

Key Diligence Focus

Fleet age and remaining useful life

Normalized EBITDA post-owner step-back

Contracted vs. spot revenue mix

Route density and service mileage

Historical CapEx vs. maintenance deferral

Bottom Line — Verdict: ⚠️ Pass (Price-Sensitive)

We like the industry.

We don’t like this asset at this price.

This is a solid owner-operator business, but at 5×+ SDE in a rural market, it lacks the scale, density, and exit profile required for attractive PE returns.

At a materially lower price, it could work.

At $1.6M, you’re not buying a platform —

you’re buying a well-run job with trucks.

In this sector, density beats exclusivity every time.

This newsletter is for informational purposes only and does not constitute investment advice. The content is based on publicly available information, and the author makes no representations about its accuracy or completeness. Readers should conduct their own research before making any investment decisions.