- Tomorrow's Fortune

- Posts

- The Only Number That Matters When Investing in a Business (and How to Calculate)

The Only Number That Matters When Investing in a Business (and How to Calculate)

Tomorrow’s Fortune

Welcome to the action-packed newsletter designed to help you navigate the world of business and investing. If you missed last week’s post, check it out here. 😎

Today’s Digest:

What Number Matters Most in a Business Acquisition? Is it revenue, SDE, EBITDA?… well I’m going to explain why it isn’t any of those!

What’s Happening in the Markets? U.S. Gov’t Shutdown Continues, Berkshire’s Earnings, China Aims for Self-Reliance, and NVIDIA’s $5T Milestone

Deal Review We found a cash flowing Security & Protection business in Georgia ($525K of Cash Flow). Click HERE for the listing (Review Below)

🚨LIVE STREAMS🚨: So many of you have asked me to start streaming! Let’s do it! Will be a chance for you all to ask me questions live, hang out while I crank and source / diligence businesses and for all of us to relax, chill and make Smart Money Moves!

Vote on your favorite topics here: Live Stream Topic Poll

TOP STORY

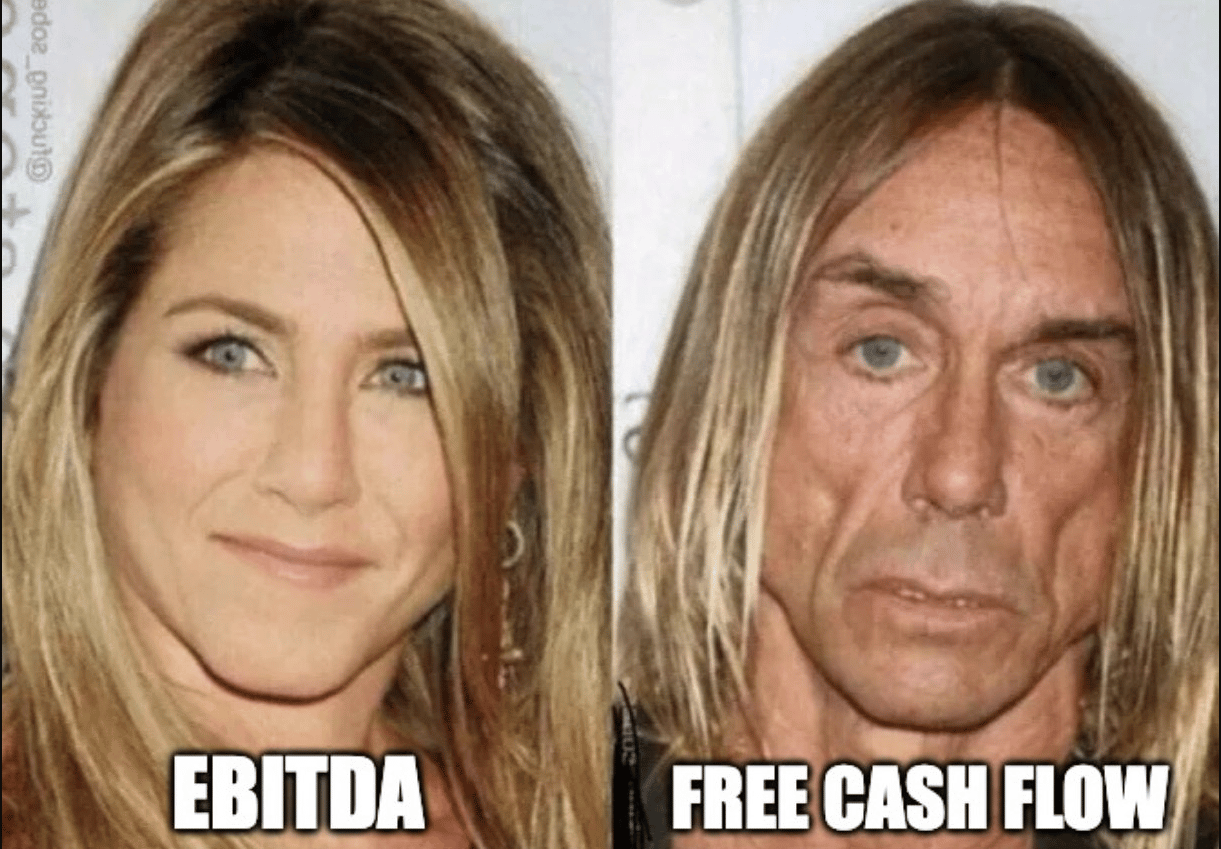

SDE vs EBITDA vs FCF… What “Truly” Matters?

Most buyers get distracted by the wrong numbers.

Revenue looks impressive.

Profit sounds good.

SDE makes the business seem affordable.

But if you’re serious about evaluating a business the way private equity does, there’s only one number that actually matters:

Free Cash Flow.

The real cash the business produces after everything is paid for.

This is the money left to:

Pay yourself

Pay your loan

Reinvest for growth

Or distribute as profit

Everything else is accounting noise.